Our Headlines

BurgherGray News

New Tax Deadlines

New Tax Deadlines by Augusto Egoavil April 20, 2020On April 9, 2020, the IRS issued Notice 2020-23, extending deadlines for the filing of a large number of forms and for making certain related payments. Deadlines have been extended in furtherance of those...

Watch BurgherGray’s CARES Act webinar

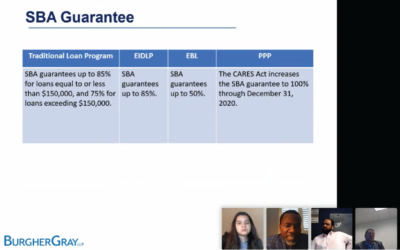

On April 9, 2020 BurgherGray's Gopal Burgher, Chris Klug, and Gaurav Parikh hosted a webinar featuring in-depth, up-to-the-minute webinar discussion of the most pressing business and legal considerations for the financial relief assistance in response to COVID-19...

Webinar: Struggling to Understand Your Options for COVID-19 Financial Relief Under the CARES Act?

Please join BurgherGray's Gopal Burgher, Chris Klug, and Gaurav Parikh for an up-to-the-minute webinar discussion of the most pressing business and legal considerations for the financial relief assistance in response to COVID-19 (Coronavirus). This comprehensive...

COVID-19 & Commercial Tenant Concerns

COVID-19 & COMMERCIAL TENANT CONCERNS by Mark Samuel April 2, 2020 by Stevan A. Sandberg April 2, 2020 Particularly as “stay-at-home” restrictions spread nationwide, the effect of the COVID-19 pandemic is felt throughout all sectors of the...

COVID-19 Gift Tax Opportunities

COVID-19 Gift Tax Opportunities by Augusto Egoavil April 1, 2020 The COVID crisis is generating tax planning opportunities as a result of lower interest rates and the capital losses accruing in assets and other property. IRS interest rates that apply to Grantor...

Tax Relief for Individuals and Businesses Under the CARES Act

Tax Relief for Individuals and Businesses Under the CARES Act by Augusto Egoavil April 1, 2020 by Christopher Klug April 1, 2020 On March 27, 2020, Congress enacted the Coronavirus Aid, Relief, and Economic Security Act or CARES Act (the...

Why the Global Elite Are Using U.S. Trusts

Why the Global Elite Are Using U.S. Trusts It's not to get their heads on Mount Rushmore. by Christopher Klug March 2, 2020 Wealthy international families are choosing U.S. situs trusts over the typical offshore trust jurisdictions. In choosing a trust...

Tour of China a great learning experience

Tour of China a great learning experience by Christopher Klug January 13, 2020I had the privilege of traveling to the People’s Republic of China from December 7 to December 15, 2019, as part of BurgherGray’s efforts to reach out to friends, colleagues, and...

Chris Klug to Tour China, Conduct Outreach On Behalf Of BurgherGray

NEW YORK — BurgherGray counsel Christopher Klug will be traveling to China in December to connect with American citizens living in China to discuss some of the complicated legal issues surrounding income and estate planning. Chris will also address United States tax...

Miami-based attorneys join BurgherGray

MIAMI — New York-based law firm BurgherGray LLP is proud to announce that four former CKR Law partners have joined the firm, immediately giving it a physical presence in Miami, Florida, and bolstering its Latin America practice. With the addition of the new...

Legal Insights

Tax Relief for Individuals and Businesses Under the CARES Act

Tax Relief for Individuals and Businesses Under the CARES Act by Augusto Egoavil April 1, 2020 by Christopher Klug April 1, 2020 On March 27, 2020, Congress enacted the Coronavirus Aid, Relief, and Economic Security Act or CARES Act (the...

Why the Global Elite Are Using U.S. Trusts

Why the Global Elite Are Using U.S. Trusts It's not to get their heads on Mount Rushmore. by Christopher Klug March 2, 2020 Wealthy international families are choosing U.S. situs trusts over the typical offshore trust jurisdictions. In choosing a trust...

Tour of China a great learning experience

Tour of China a great learning experience by Christopher Klug January 13, 2020I had the privilege of traveling to the People’s Republic of China from December 7 to December 15, 2019, as part of BurgherGray’s efforts to reach out to friends, colleagues, and...

1350 Broadway | Suite 1510

New York, NY 10018

T: 646.513.3231 | F: 646.561.9866

This website contains attorney advertising. Prior results do not guarantee a similar outcome | Copyright © 2020. All rights reserved. Terms & Conditions and Privacy Policy